Many Brokers/real estate sales agents and sellers have cordial and productive relationships working toward a common goal of selling a property. Still, there is one occasional point of contention that must be worked through at the beginning of the relationship that can set the tone for the entire engagement: COMMISSIONS.

NOTE: Although we mostly use the term “commission(s)” in this article, Broker and agent compensation can take many forms. It is all NEGOTIABLE in real estate.

Preamble: Why are Real Estate COMMISSIONS Negotiable?

Real estate is one of the largest industries in the country, and as such, it keeps the attention of lawmakers to make sure the industry is fair to consumers. Real estate is an example of an industry guided by anti-trust laws that are intended to protect competition and prevent monopolies, all with the end goal of protecting consumers and advocating for the best services and costs to consumers.

The arrangement of having a negotiable commission structure in real estate is intended to prevent price fixing. In the real estate industry, price fixing pertains to both the fees a brokerage charges for services, as well as the compensation a brokerage will pay to a cooperating brokerage (i.e., the “split”).

Keeping with the guidelines of anti-trust laws, know that any examples cited in this article are ONLY EXAMPLES for the sake of understanding – not for suggesting recommended fees.

Whether sellers and agents like it or not, the negotiable commission structure is here to stay.

Why are Real Estate Commission Such a Tender Spot for Some Parties?

“Some sellers view the commission they have to pay as money coming out of their pocket or sale proceeds,” said Robert Coscia, Broker and Owner of Personal Realty Advisers. “Other sellers just have an opinion about how much they think real estate agents should make for their work, and that’s all they are willing to pay.”

Looking at an example, if a home sells for $250,000, a negotiated commission of 6 percent of the sale price would result in a commission payment of $15,000 to the listing Broker at the closing of a successful home sale. If the home sells for $1,000,000 (at a 6 percent commission), that payment would be $60,000. As explained below, that commission likely gets divided among multiple parties involved in the sale process.

“Some sellers think that’s simply too much for the work we do, and they don’t feel they should have to pay it,” said Coscia.

Coscia said there are three main reasons why it’s difficult for some sellers to understand commissions:

- Commissions are usually divided among multiple parties, which greatly reduces the amount any single real estate professional makes.

- There are many costs required to run a brokerage, to be a Realtor, and to produce a successful home sale.

- Commissions are disbursed from the sale of the home, which is paid for by the buyer; thus, the buyer is indirectly paying their buyer’s agent’s compensation through the purchase price. Buyers assume the price they pay for a home includes fair compensation for their buyer’s agent.

How are Real Estate Commissions “Split”?

Coscia explained that the seller usually interacts only with one person when setting the sale commission – his/her listing agent or Broker. In actuality, multiple parties are involved in the home sale and the corresponding distribution of the sale commission.

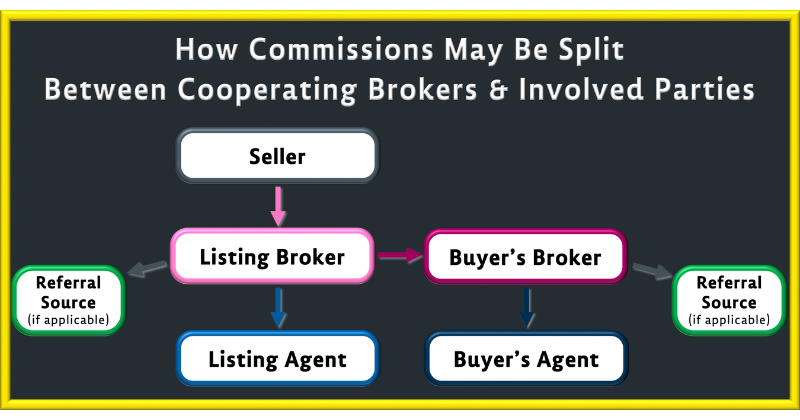

The seller’s listing agreement, which also defines the commission/ compensation, is entered into with the listing Broker, because all listings belong to the Broker, not the sales agent. The listing Broker usually offers to split the commission with the selling brokerage. Those two Brokers then give a share of the commission to the real estate agents working on the sale. Sometimes, there are additional fees to cover administrative expenses.

Therefore, what started as a $60,000 commission for a $1,000,000 sale gets broken down several times.

The split among brokerages is often 50/50, said Coscia, “but it doesn’t have to be. Commissions and commission splits are negotiable, and it’s up to the listing Broker and seller to determine breakdowns that are fair and in the best interest of parties involved – especially the seller.”

With a 50/50 split, that means for the previously mentioned $60,000 commission, only $30,000 is going to the listing brokerage, unless that brokerage also represents the buyer (“both sides of the sale”).

The Broker keeps a percentage of that $30,000 to cover his/her management and operating expenses, and the balance goes to the sales agent. That portion is also negotiable and usually is set when the brokerage subcontracts with (engages) the sales agent. The commission split is often based on the agent’s level of expertise, years working in the industry, and earning potential that can benefit the brokerage.

If the brokerage keeps 20%, then the listing agent will receive $24,000.

“That’s still a lot,” said Coscia, “but keep in mind there are many expenses that both the brokerage and the listing agent must cover.”

Especially costs to prepare the home for market, said Coscia. “At the beginning of the Broker-seller relationship, many sellers do not realize the extensive time, costs and work we put into getting a property ready for market. Most homes are not ready for market in their everyday condition.”

What Do Real Estate Commissions Cover?

From a big-picture perspective:

- The seller is paying the listing brokerage to manage and facilitate a successful home sale.

- The listing Broker splits that compensation to pay a buyer’s brokerage for bringing a ready, willing and able buyer to the table and for a successful closing.

- Both the listing and buying brokerage pay the sales agents for being the front-persons involved in the sale, responsible for working with clients and managing most sale logistics.

- Sometimes a referral fee needs to be paid if the seller or buyer was referred by another licensed brokerage.

“Certainly, all those splits are not full profit to the individuals paid,” said Coscia. “Running a brokerage, being a Realtor, and producing a successful sale requires a great deal of work and incurs many expenses.”

The portion of the commission kept by the brokerages helps cover their management and overhead:

- The Broker’s time to supervise the transaction

- Multiple licenses and membership dues are required simply to be in the real estate business

- Education and training required to maintain licensure

- Insurances required for company protection

- Taxes for both business and personal income tax

- Administrative expenses including technology, office overhead, promotion, and much more

Similarly, the real estate agent must pay for taxes, licenses, dues, training, transportation, overhead, promotion and more. They also pay many expenses involved to facilitate the actual sale.

“In our brokerage, we invest a lot of our own funds and time into promoting the sale of a home,” said Coscia. “This is a partnership, and we put our all into it.”

Personal Realty Advisers usually covers some of the following expenses as a courtesy:

- Professional yard signage

- Professional photography of the home for the listing and promotion

- Drone / aerial photography

- Matterport / 360-degree virtual tour

- Dedicated website for the property

- Open house materials such as signage and promotional flyers

- Often promotion, such as mailings to the surrounding neighborhood or condominium complex, or advertising in targeted outlets

- Other marketing for social media promotions and distribution through multiple channels

In some cases, it may also be necessary to pay for other services such as repairs, landscaping, professional staging services, cleaning and more. Sometimes agents get reimbursed for those expenses by the seller, explained Coscia, and sometimes they don’t. “Many agents just accept them as necessary extra expenses needed in order to achieve a successful sale.”

Who Pays Real Estate Commissions?

The seller and the listing Broker are typically responsible for setting the real estate commission rate to be paid with money earned from the property’s sale. Still, you cannot literally say, “The seller pays the commission.” Buyers anticipate that part of the purchase price they are paying will go to a fair compensation to their agents, as well.

Looking at it from a different perspective, consider a home that is “For Sale By Owner” (FSBO). Deal-shopping buyers may anticipate a FSBO home to be priced lower than those sold through the MLS, specifically because no commission is to a listing brokerage.

Thus, for a property sale through the MLS, if a full and fair commission is NOT being paid to the listing agent, in theory, those funds should be deducted from the sale price.

“That’s not how sellers see it, of course,” said Coscia. Sellers are mostly concerned with how much of the sale price they will get to keep. “In one sense, if a seller goes for a full-force sale price but negotiates a lower Broker’s commission, one could view that as the seller taking money out of the Broker’s pocket.”

Bottom Line: How Much Should Be Paid in Commission?

Numerous online real estate vendors have touted “average” commission rates in Florida being roughly between 5.5% and 6%. Keep in mind that many of those sources compete against traditional real estate brokerages, and in many cases, no source is identified for the data proclaimed.

A key consideration when selling your home and working with the listing brokerage to set the commission is: How much service do you want? There are discount brokerages available that charge a lower commission or flat fee, but the tradeoff is less service directed to the sale of your home.

“Most sellers are concerned with the bottom line – the sale price,” said Coscia. Maximizing their sale outcome requires a lot of personalized attention and care that a full-service brokerage like Personal Realty Advisers is committed to providing. “Sellers want and usually need that full service, but they don’t always want to pay for it.”

Reduced Commission? There are valid reasons why a seller and Broker would negotiate a lower commission, such as some of the following:

- The seller is a repeat customer.

- The home is in top-notch condition and will be easy to sell.

- The market is such that sales do not require as much work from the real estate agents.

- The listing Broker brings the buyer to the sale.

- Other personal reasons that may exist for the Broker and/or seller.

Conversely, there also are times when commissions should be increased when special situations exist that require extra time, effort and/or risk by the listing brokerage.

“At Personal Realty Advisers, we always try to work out an agreeable commission plan,” said Coscia. “Our goal is to help our clients, and we always do everything we can to achieve a successful sale and minimize stress for the seller.”

One area of flexibility within Personal Realty Advisers is the fact that a seller’s listing agent ALSO is the Broker and Brokerage Owner. There’s no needless back-and-forth negotiations between the agent and his Broker, because WE ARE the Broker and Owner.

To learn more about how our Broker will work with you directly to help you with your sale (or purchase), call him: Robert Coscia, Broker, Owner and Realtor (727-317-7653).

“Get it done right the first time,” said Coscia. “Call us now to learn why and how we do our work for your benefit.”

Leave a Reply