One of the highest costs of homeownership can be property tax, which varies according to the city or county in which you reside. Understanding and taking advantage of the Homestead Exemption can help homeowners reduce their property taxes in both the short and long-term, especially in a booming market.

“Florida laws pertaining to property taxes are unique, and many of our clients relocating from other states and countries aren’t sure what tax savings will apply to their situation,” said Robert Coscia, Broker and Owner of Personal Realty Advisers. “One of the most frequent topics we address with clients is the importance of declaring homestead on their Florida property to reduce their property tax liability.”

Known as Florida’s “HOMESTEAD EXEMPTION,” this tax benefit reduces the assessed value of your real property, thereby lowering the amount of property tax owed. Establishing your homestead also is important because it goes hand-in-hand with the Save Our Homes Assessment Limitation and the Homestead Portability, which can provide significant tax reductions over time and when you relocate (both explained below).

How It Works

While Florida does not tax income at the state level, Floridians who own “real property” are required to pay “real property taxes.” The specific amount of money owed is based on the value of the property’s land and building. The amount owed also can be offset by EXEMPTIONS, one of the biggest being the Homestead Exemption and assessment limitation linked to it: the Save Our Homes Assessment Limitation, and Homestead Portability. Each of these adds an important layer of cost savings for homeowners.

Homestead Exemption

When you own property in Florida and make it your permanent residence (your HOMESTEAD)—be it a single-family home, condominium, townhome or villa, or even certain mobile home lots or half of a duplex—you can apply for the HOMESTEAD EXEMPTION that reduces the property’s assessed value from tax liability by EXEMPTING as much as $50,000.

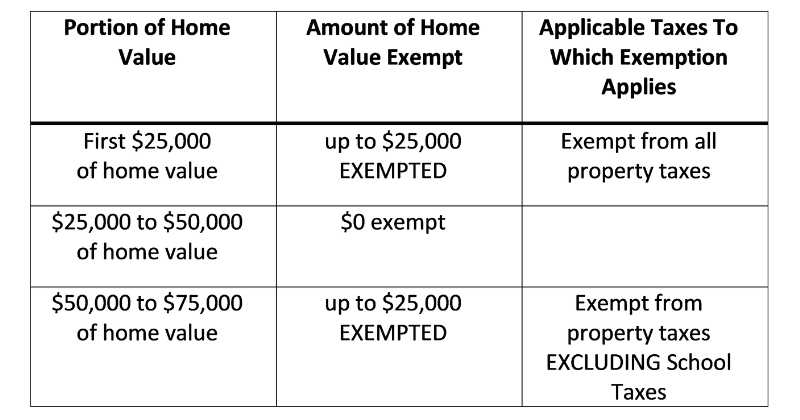

The Florida Constitution provides this tax-saving exemption on the first and third $25,000 of the assessed value of an owner-occupied residence. Since the exemption is a state law, it’s the same no matter where you live in Florida.

The Property Appraiser uses a tier formula to calculate property tax exemptions, as shown below.

To understand homestead, it also is helpful to know the multiple terms used to describe your home’s value. Every parcel of real property has a JUST VALUE, an ASSESSED VALUE, and a TAXABLE VALUE.

To understand homestead, it also is helpful to know the multiple terms used to describe your home’s value. Every parcel of real property has a JUST VALUE, an ASSESSED VALUE, and a TAXABLE VALUE.

- The just value is the property’s market value, often used to help set a home’s selling price.

- The assessed value is a yearly estimation of your home’s worth as determined by your county property appraiser. For homes that are homesteaded, this becomes the just value minus assessment limitations (described below under “Save Our Homes”).

- The taxable value is the assessed value minus exemptions. It is the value the tax collector uses to calculate the taxes due on the property.

Save Our Homes Assessment Limitation

The Homestead Exemption is the first point of tax saving. Beyond that, homeowners with a homestead exemption can keep a cap on their assessed/taxed home value through the Save Our Homes assessment limitation. This limitation was put into law by Florida voters in the early 1990s to help combat runaway property taxes resulting from a booming real estate market.

Save Our Homes is an assessment limitation (or “cap”) on increases in the assessed value of a homestead residence. The cap limits annual assessment increases to 3% or equal to the percentage change in the Consumer Price Index ─ whichever is less.

When a property is granted homestead, it is assessed at the “just value” (full market value) as of January 1 of the same year, thereby establishing the base “cap.” Each year after that, regardless of real estate booms, the “Save Our Homes” cap benefit protects Florida homeowners from unaffordable yearly reassessments. It remains in effect as long as the property is homestead exempt or until the property is sold.

“This is one reason why we advise buyers not to look at or focus on the ‘property taxes’ shown in a property listing,” said Coscia. “The tax shown might be for a home that has been protected by the Save Our Homes cap for years or decades, protecting it from exorbitant market rate increases.”

The Power of “PORTABILITY”

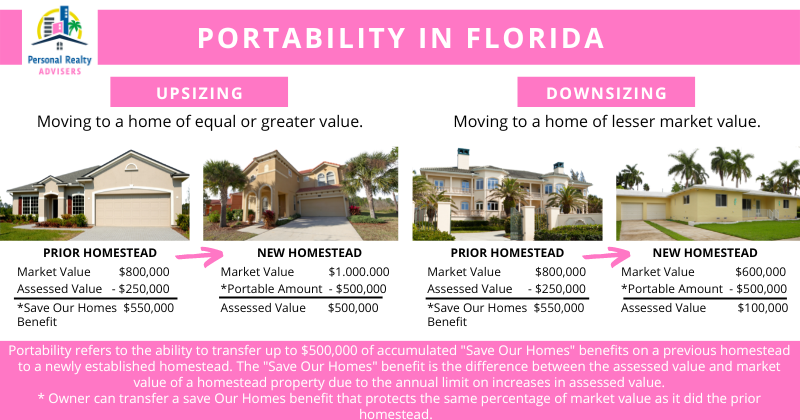

The third way Homestead benefits property owners in Florida is through “Portability” – the ability to transfer homestead and years of capped (protected) tax increases to your next home within the state of Florida. As shown in the graphic below, homeowners can transfer or “PORT” all or part of their accumulated Save Our Homes benefit to their new permanent residence. The maximum property value offset allowed to be “ported” is set at $500,000, as long as the homestead was in place during any of the three tax roll years preceding the year for which you established your new homestead.

Example: You Sell Your Homestead Property in 2023. Regardless of the month you sell your homestead property, the qualified homestead exemption date would be January 1, 2023. You would have until January 1, 2026 (i.e., three tax years) to obtain a new homestead exemption to port the “Save Our Homes” benefit to your new Florida home.

Other Tax Exemptions

There are many other tax exemptions for which Florida homeowners can apply, including exemptions for property owners with disabilities, senior citizens, veterans, active-duty military service members, disabled first responders, properties with specialized uses, and more. A full list of property tax exemptions is available from the Florida Department of Revenue.

At Personal Realty Advisers, our professional and knowledgeable real estate agents know both sides of the buying and selling process, and they have extensive experience regarding these exemptions and benefits. We work closely with clients to determine if they qualify for any additional savings.

If you think you may qualify for these or other exemptions, please discuss them with us.

SPECIAL AUDIENCE: Making Your Second-Home Permanent

As a trusted Broker and Realtor in the Tampa Bay/St. Petersburg area with over 30+ years of real estate experience, we frequently work with clients who have a Florida vacation home while maintaining a primary residence elsewhere. Vacation homes do not qualify for homestead exemption, but as circumstances change, especially as retirement approaches, homeowners can turn their vacation home into their homesteaded property when they establish permanent residence.

Applying For Homestead

A Florida homestead exemption is not automatic upon purchasing a home. Florida statutes set firm requirements for eligibility, and an application must be submitted. Certain contingencies limit property rental (i.e., property rental can jeopardize your homestead status).

By law, January 1 of each year is the date on which permanent residence is determined for the tax year you are filing. For example, to claim a homestead exemption for 2022, you would need to own and live at the property starting January 1, 2022, and meet these qualifications:

- Be a permanent Florida resident

- Own and “reside on” the property as your permanent residence

- Hold title or beneficial interest in the property

- Be a U.S. citizen or possess a Permanent Residence Card

SPECIAL NOTE ON “RESIDING”: Note that the requirement to “reside on the property” is not the same as requiring a physical presence on the property, according to a Florida State Attorney General’s Opinion. There may be situations when a property owner cannot physically occupy the property by January 1 of the homestead year; for example, he/she is in the process of moving, is in a nursing home, is staying elsewhere in a vacation home, etc. As long as the intention of the property owner was to make the residence their permanent home as of January 1, the home can qualify for homestead. If this situation applies to you, we recommend you contact your property appraiser’s office. They will walk you through the guidelines that apply to your specific situation.

After completing the application for homestead exemption (Form DR501), it needs to be filed by March 1 of the year you wish to qualify, which can be done online through the e-file option, by mail, or by visiting your county property appraiser’s office in person. You can find and access your property appraiser from the state website.

The Florida State application form requests specific information for all owners living on the premises and filing. Be prepared to provide:

- Current employers of all owners listed on your last IRS income tax returns

- Date of each owner’s permanent Florida residence

- Date of occupancy for each property owner

- Social Security numbers of all owners filing

- Social Security number of any married spouse of the applicant

(even if the spouse is not named in the deed and is not filing) - Utility statement that shows a payment for services has been made

You don’t have to resubmit a new application yearly, as the Florida Statute requires your homestead status to renew automatically. It can last your entire lifetime provided you continue ownership, and the property remains your primary residence.

Proof of residence is required, so also have the following documents available that reflect the address of the homestead property:

- Florida Driver’s License (or official Florida State ID if you do not drive)

- Florida Vehicle Registration

- Florida Voter’s ID (if you vote)

- Immigration documents if you’re not a U.S. citizen.

Note: there could also be implications for how much of your home you can claim for exemption if you rent out portions of your home or if you have a home-based business. Learn more here.

We Are Here to Help

We understand that the many statutes and amendments impacting homeowners in Florida can be complicated and confusing. The “legalese” behind homestead exemptions and assessment limits can be challenging to calculate and comprehend. During your home buying process, we will work with you to identify how these laws apply to your specific situation.

If you are unsure about qualifying or need assistance verifying that you are receiving the homestead exemption, your local county officials are there to help. Remember, it could save you hundreds, if not thousands of dollars each year in property taxes.

Leave a Reply